UK debt 2 trillion, UK government spending on virus measures pushes

UK debt 2 trillion, UK government spending on virus measures pushes.

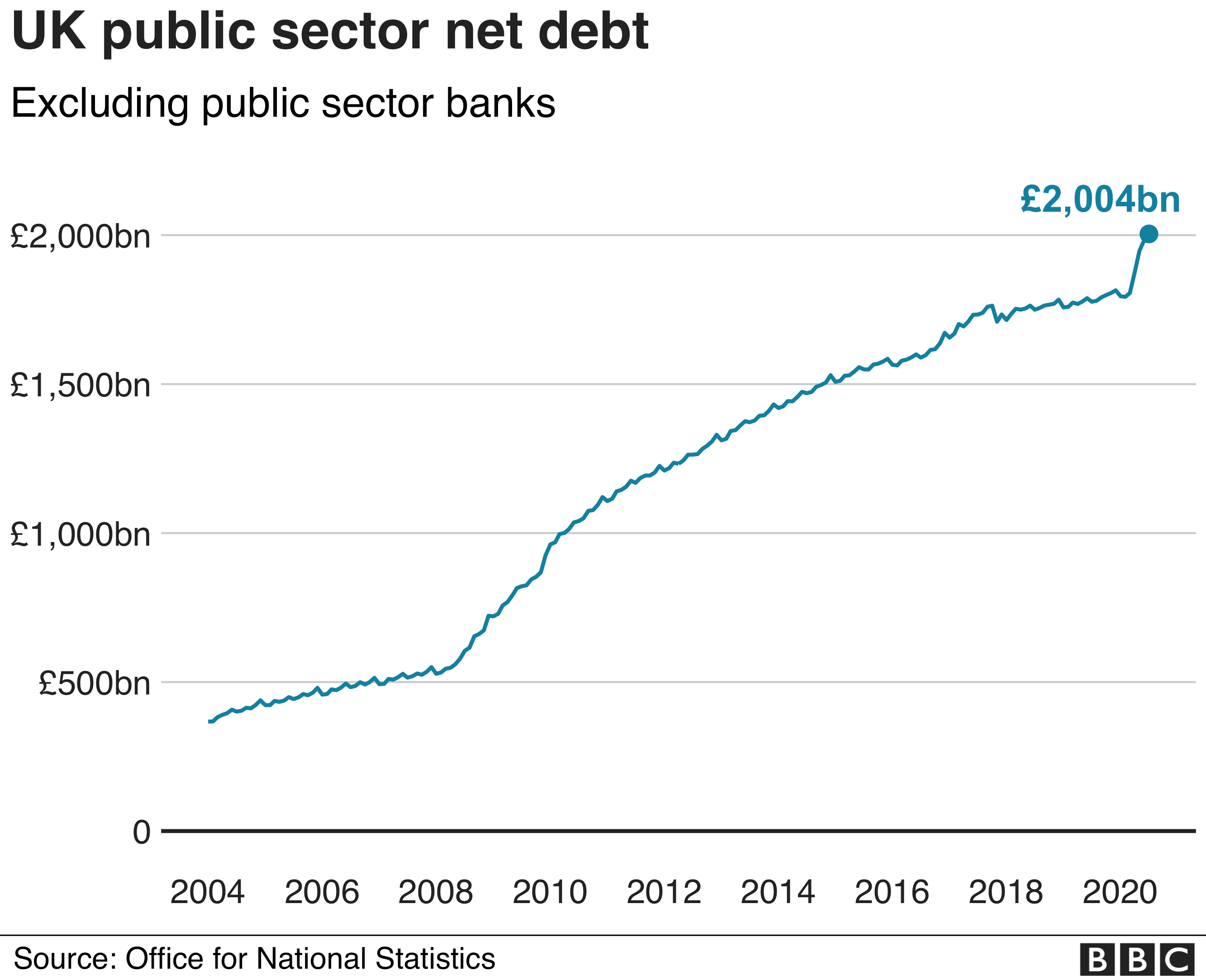

UK government debt has risen above £2 trillion for the first time amid heavy spending to support the economy amid the coronavirus pandemic.

Spending on measures such as the furlough scheme means the debt figure now equals the value of everything the UK produces in a year.

Total debt hit £2.004tn in July, £227.6bn more than last year, said the Office for National Statistics (ONS).

Economists warned the situation would worsen before improving.

It is the first time debt has been above 100% of gross domestic product (GDP) since the 1960-61 financial year, the ONS said.

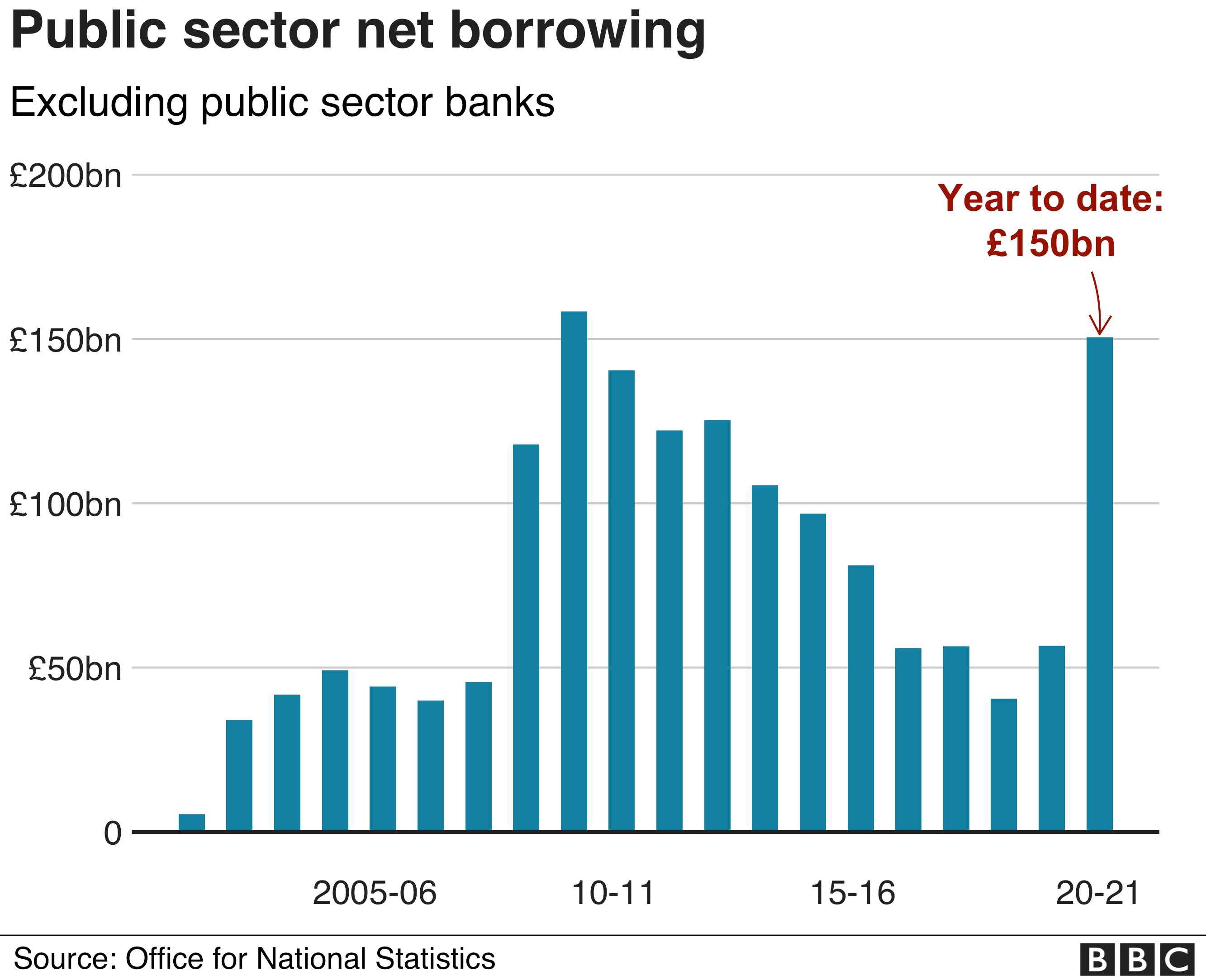

The July borrowing figure - the difference between spending and tax income - was £26.7bn, down from a revised £29.5bn in June.

It was the fourth highest borrowing in any month since records began in 1993. The three higher figures were the previous three months.

Those are big figures. What do they mean?

Ruth Gregory, senior UK economist at Capital Economics, said July's borrowing figure was "another huge sum and pushes borrowing in the year to date to £150.5bn".

"That is close to the deficit for the whole of 2009-10 of £158.3bn, which was previously the largest cash deficit in history, reflecting the extraordinary fiscal support the government has put in place to see the economy through the crisis."

Chancellor Rishi Sunak said: "This crisis has put the public finances under significant strain as we have seen a hit to our economy and taken action to support millions of jobs, businesses and livelihoods.

"Without that support, things would have been far worse.

"Today's figures are a stark reminder that we must return our public finances to a sustainable footing over time, which will require taking difficult decisions."

Comments

Post a Comment